Choosing the right life insurance can feel overwhelming, especially with so much conflicting information out there. Let’s clear up some common misconceptions and arm you with the facts.

Life Insurance is Only for the Elderly

This is a major myth! While it’s true that life insurance needs often change as you age, young adults and families often benefit the most. Securing a policy early, when premiums are lower, can provide crucial financial security for loved ones in case of unexpected events. Think about protecting your future family or paying off a mortgage – life insurance can play a vital role regardless of age.

I’m Too Young/Healthy to Need Life Insurance

Health status is a factor in determining premiums, not eligibility. Unforeseen events can impact anyone. Even if you’re young and healthy, securing a term life insurance policy now locks in lower premiums and protects your future self. Learn more about the types of life insurance policies available to better understand your options.

Life Insurance is Too Expensive

The cost of life insurance can vary widely based on factors like age, health, and the type of policy. It’s essential to shop around and compare quotes from different insurers. There are also affordable options such as term life insurance, which provides coverage for a specified period. Exploring options and understanding your budget is crucial.  Don’t let the price scare you away from securing your family’s financial well-being – a little planning goes a long way. You can also use online calculators to estimate costs.

Don’t let the price scare you away from securing your family’s financial well-being – a little planning goes a long way. You can also use online calculators to estimate costs.

I Can Rely on My Savings and Investments

While savings and investments are important, they don’t replace life insurance. Savings can be depleted, investments can lose value, but a life insurance policy guarantees a payout to your beneficiaries. It’s a crucial safety net providing peace of mind and financial security. Read our guide on the importance of estate planning to understand how life insurance fits into a comprehensive financial strategy.

Only High-Income Earners Need Life Insurance

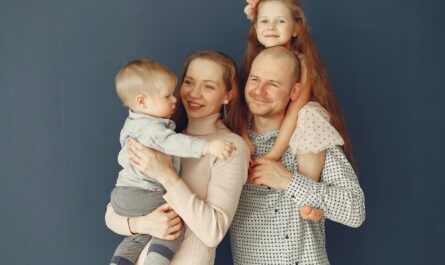

The need for life insurance isn’t determined solely by income level. It’s about protecting your loved ones from the financial burden of your absence, regardless of how much you earn. Even a modest income can support a family, and the cost of raising children or paying off debts could be overwhelming without life insurance. [IMAGE_3_HERE] Consider the financial impact on those you support and what level of coverage is appropriate.

The Application Process is Too Complicated

Applying for life insurance is easier than you might think. Many providers now offer simplified online application processes. While some policies might require medical examinations, many term life insurance policies only need basic health information. Check out this insurer’s simplified application process for a streamlined experience. Don’t let perceived complexity deter you from securing your family’s financial future. This article simplifies the application process.

Ultimately, choosing life insurance is a personal decision, but understanding the facts can remove the fear and uncertainty surrounding it. By debunking these myths, we hope to empower you to make informed choices about securing your family’s future.

Frequently Asked Questions

What type of life insurance is right for me? The best type of life insurance depends on your individual needs and financial situation. Term life insurance is typically more affordable, while whole life insurance offers lifelong coverage and cash value.

How much life insurance coverage do I need? This depends on your financial obligations and the needs of your family. Consider factors such as outstanding debts, future education expenses, and your dependents’ living expenses.

Can I change or cancel my life insurance policy? Most life insurance policies allow for changes, such as increasing or decreasing coverage, though there might be limitations or fees. Cancellation is usually possible, but may result in the loss of coverage and accumulated value.

What if my health changes after I get a policy? Changes in your health might affect your premiums or your ability to maintain your coverage. Check your policy documents or consult your insurance provider for detailed information.

Are there any tax benefits to owning life insurance? Yes, there can be. Depending on the type of policy and the circumstances, death benefits may be tax-free to your beneficiaries, offering considerable financial advantages.Learn more about tax benefits from a financial advisor.